Powell's Bullish Signal To Markets | Weekly Roundup

Follow On The Margin On Spotify: https://spoti.fi/46WWQ6T

Follow On The Margin On Apple Podcasts: https://apple.co/3UsnTiM

Follow Blockworks Macro On YouTube: https://bit.ly/3NKpujX

—

This week we discuss the bullish setup post FOMC & QRA. We also discuss the rise of distrust in institutions, Japan’s Minsky moment, the rise of passive & more. Enjoy!

—

Kinto is the Safety-first L2 designed to accelerate the transition to an on-chain financial system. It features user-owned KYC and native account abstraction to solve the biggest blockers to mainstream adoption: security and user experience.

Kinto’s launch program is onboarding institutional players and DeFi users before its public launch. If you believe in bridging the gap between TradFi and DeFi today, join Kinto’s launch program at https://engen.kinto.xyz

—

Join us at Permissionless III Oct 9-11. Use code: MARGIN10 for a 10% discount: https://blockworks.co/event/permissionless-iii

—

Follow On The Margin: https://twitter.com/OnTheMarginPod

Follow Felix: https://twitter.com/fejau_inc

Follow Tyler: https://twitter.com/Tyler_Neville_

Follow Quinn: https://twitter.com/qthomp

Follow Mike: https://twitter.com/MikeIppolito_

—

Disclaimer: Nothing discussed on On The Margin should be considered as investment advice. Please always do your own research & speak to a financial advisor before thinking about, thinking about putting your money into these crazy markets.

source by Blockworks Macro

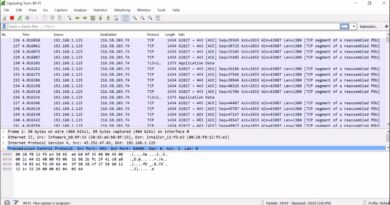

simple network management protocol

Thanks

Great episode! Always look forward to your weekly roundup. The explanation and analogy of airdrop are good 👍

Marty was telling Do Kwon that jail wasn't that bad, SBF wasn't on that lost episode of UpOnly

you could, technically, but why would you want to?

These dudes talk the same

Like the same dude in a different body

Bring back yusko

Love how Coinbase's horrendous reliability (during high-demand periods) never gets mentioned when they inevitably go down. Not ready for primetime imo (especially as they're the default custodian for most of the ETFs)

Been listening to the podcast for 6 months – which has been hard to follow. So glad I found you guys on here – great to see your faces and the content you are discussing. Subscribed and will consume your content here. Thanks

So from expected 4.5 to 5.5 terminal rate….not cutting interest rates, still qt going on

How is this bullish. Like are you guys getting paid by hedge fund to influence people

This is the best one yet

The recent stock market rally has left investors questioning whether it's the end of the bear market or a sign of volatility to come, especially with traditional indicators like the inverted yield curve signaling caution. In such a climate, pivoting to the dynamic world of cryptocurrencies could be a wise move. Despite a potentially bearish stock market, the crypto market remains a hub of innovation and opportunity. Amidst this the insights of a knowledgeable guide like Whitney Eston can be crucial. Her expertise in navigating the nuances of cryptocurrency investments could be the key to understanding and making the most of these emerging financial trends.

great point Felix re ' all over the place politically.' Should be taken issue by issue not blanket adherence to a dogma

precisely – patriotism has nothing to do with 'white supremacy'. Anyone conflating the two is the problem.

🤣🤣 FUNNY 🤣🤣

They mocked Biden dude for failing to explain money then they themselves failed to explain the crypto airdrops 🤣

I'm favoured financially with Bitcoin ETFs, Thank you buddy $32,000 weekly profit regardless of how bad it gets on the economy.

Bitcoin is a token of nonsense. Not am asset. Tiresome. Sophomoric. Cultissh.

This might not age well…

Are you saying you do not have biases? Blockworks!

Without a big sell-off there can be no major rally.

Bond King publicly says Don't Buy Bonds?

Buy Fear Sell Greed.

Also public FUD while Getting Private Fund Fills?

Mike: MAGA guy here. But were a self interested country like anyone else! Our media said the LUSITANIA was not carrying munitions! Remember learning that in school????????? The rape of Belgium 1914?

Great chat gents. Thank you

I feel Tyler is not realling saying anything. The growth of "passive management" and the fall of gatekeepers is not communism it is what unregulated capitalism brings.

This seems like the worst period.

Even the market are now very unpredictable. Started investing recently when the market prices were a bit high,today I am more than 60% down!

Great panel 🙌🏼 Look forward to this show every week.

The SBF clip isn’t real it was Zhu though

It's crazy how much tyler is a btc only perspective lol reeeeeeaaaally appreciate the balanced panel u guys have here Tyler included. He's a sharp guy, it just blows my mind for somebody in this industry to say "can someone please explain airdrops" 😆 truly the embodiment of what id expect a bitcoin only person to say (*chefs kiss*)

Lessee,… these guys are perplexed by and whining about how they can't do true value investing in the market,… whose motto has been forever,… that the market can stay irrational longer than you can stay solvent,.. and now we have computers and algos on cruise control,… and pining for the day "they can take over",… but until then,… they're going to "invest in shitcoin",…

Are youpheckingkidding me???

1. Buffett didn't get permission to "take over" 50 years ago. Anybody can take over at any time,.. ya just gotta be smarter than the market.

2. What are you going to do when you "take over",. force the market to trade on real value"??

3. Shitcoin is the epitome of a meme irrational valueless market.

It has no intrinsic value,.. it pays no dividends or earnings,.. there's no there there,.. so it's not a store of value.

It's volatile,.. nobody takes it,.. so it's useless as a currency.

Mygawd I'm tired of snowflake millennials whining,. and their voting for the insane policies,…. of stimi checks, working from hone or worse getting paid even if they fon't work,…the inflation acceleration act aka the green new ponzi scheme, the chips act,.. and all of the other country destroyiing MMT deficits and debt don't matter nonsense,.. when we're not even in a recession,.. all just for the incompetent corruptsenile ole joe admin and the demcorats to buy votes to try to stay in permanent power,…… and then blame others for the disastrous results of their shitforbrainsvoting.

I'm outa here.

Please stop using finance lingo. I understand that you're all professionals who are formally educated and you all understand each other, but for the sake of us retail boobs, please stop it. When you say something is "buffered" or "comped" I have no idea what is meant by that and worse is I'm not going to find slang in a financial terms dictionary. Like if you say "QRA", I can look that up. But when you use some noun-cum–verb to describe a complex process, I'm lost. I'm sure I'm not the only one, I'm just the guy who is willing to admit it.

The idea behind investment was that you were investing in a company with a product or service that would become a profitable company and you would share in the growth and profit of the company. It is nothing like that anymore for market makers and players that are leading the market.

Point made at 13 minutes is spot on. What the market allows to go on with the algorithms buying despite everything based on certain momentum defies any kind of actual idea of investment. At this point it is all just manipulation and gaming.

Freaking fools in regulation could have stopped this by not allowing stock buybacks while interest rates are so damn low. It creates no extra productivity. It's like burning your cash to keep your house warm

Great episode. I really appreciate that you guys are able to pinpoint how broken the financial system and several other segments of society are without resorting to the type of lazy conspiratorial thinking that is so prevalent in the crypto and finance space.

Thanks guys

Good show. Keep it up.